GM

Let’s talk about crypto gambling.

Now, we don’t mean the usual ‘invest-your-inheritance-into-a-coin-named-after-Elon’s-latest-pet’ type of gambling. No, today we’ll be covering the Wild West of crypto casinos and - more specifically - their associated platform tokens.

Casino tokens market themselves as a bet on the house, an inherently attractive proposition given the fundamental principle of casinos - the house always has an edge. Rather than being lambs for the proverbial slaughter, regular users now have a means of sharing in the profits.

But are these tokens really the free bet they are made out to be?

In today’s Ribbit we will deep dive into the casino craze, see what’s hiding behind the curtain and give you some points to consider before you have a flutter on the hottest show in town.

Roll up! Roll up!

Where better to start than the casino that kickstarted the recent mania - Rollbit.

Rollbit is an online betting platform with a core offering that includes a casino, sportsbook, NFT gambling, loans and - last but by no means least - 1,000x leverage crypto trading. Never before have you seen an array of products so adept at parting users from their money (which is, of course, entirely by design).

Rollbit offers the usual suspects in terms of traditional casino games in addition to an extensive range of bespoke originals, all operating on top of sleek UI. The team is constantly rolling out new ways to gamble your funds, such as a recently announced duel arena inspired by Runescape (instead of losing a set of Third Age Armour, you can lose your house!)

Rollbit has picked up various cheerleaders over the course of its rise to fame, chief among them being Gainzy - a perfect partner for the platform given his notoriety for high-risk, high-reward trades. Others, such as Pentoshi, have publicly endorsed RLB on the basis that: “betting on human greed and products people use seems a good long-term bet”.

The method by which Rollbit returns value to users is via the deflationary tokenomics of its platform token - RLB.

Rather than implement direct token buyback and burns, Rollbit uses a lottery system to achieve its deflationary supply. Every 100 BTC blocks (~16 hours), 20% of Rollbit's assumed profits are deposited into a lottery pool.

The more RLB you stake, the higher your chances of winning the lottery. Users pay 0.2% of their stake as fees, half of which is then burned.

This is a novel and enjoyable way of returning profits to users, which has been reflected in the token’s price. Taking the burn into account, RLB currently sits at an impressive market cap of ~$150 million.

(Not Quite) The Only Show in Town

Rollbit is by no means alone in its attempts to corner this lucrative corner of the crypto market. In fact, this niche is rapidly becoming saturated with an array of challengers spread across multiple chains, including:

Arcadeum (ARC) - markets itself as having no house edge.

Arbi Roul (ROUL) - deflationary supply and NFT staking.

BetSwirl (BETS) - a relatively high-quality platform that will be expanding to Arbitrum in the next quarter.

Blockchain Bets (BCB) - generated $60k in revenue in 30 days, which admittedly isn’t too shabby. It claims to have over 2,000 live games (we will not be manually counting them to verify).

JustBet (WINR) - soon to launch via public sale on the Camelot DEX on Arbitrum.

PepesGame - teaser screenshots suggest the platform will have a decent UI but there is little other information available. You can try to earn whitelist spots in their Discord.

PPBET (PPBET) - launched late last week, doesn’t look particularly novel at a glance.

Risky.lol (DICE) - one of the first movers on Arbitrum and relatively established but has also undergone initial price discovery.

Shuffle - touted as Rollbit’s main competitor by many and perhaps the most anticipated in terms of a future token airdrop, has an undoubtedly polished feel and sleek UI.

ZKasino - another platform with massive hype, multi-chain and likely the subject of a future airdrop for early users.

Speculators have been quick to flock to these microcap tokens in hopes that they are early to the next Rollbit.

However, if you need an example of how quickly these platforms can implode, look no further than the inventively termed ‘ArbitrumGameCoin‘ (AGC), which rapidly rose to a multi-million dollar valuation before the team suddenly realised their operation would require a gambling license.

A similar fate is likely to befall many of the projects listed above.

Wild Wild West

This leads us to the cloud that looms large over all crypto casinos - the fact that their regulatory status can be charitably described as ‘dubious’.

Let’s take the more ostensibly reputable examples above - Rollbit, BetSwirl and Shuffle. What does each have in common? The answer is, of course, Curaçao (the island, not the radioactive blue liqueur that goes into cocktails that your girlfriend drinks on holiday).

Curaçao is an offshore regulatory haven that has become the de facto homeland for online casinos and gambling platforms in recent years. Another famous denizen of Curaçao is Stake.com, which took Twitch and other social media streaming platforms by storm during the pandemic.

Without delving into the specifics, it is sufficient to say that the process of obtaining an online casino licence from the Curaçao authorities is relatively lenient. We imagine it looks a little like this:

One of the primary consequences of this light-touch regime is that ‘regulated entities’ can get away with offering little to no transparency around matters such as reserves, account restrictions, data protection and fees and charges.

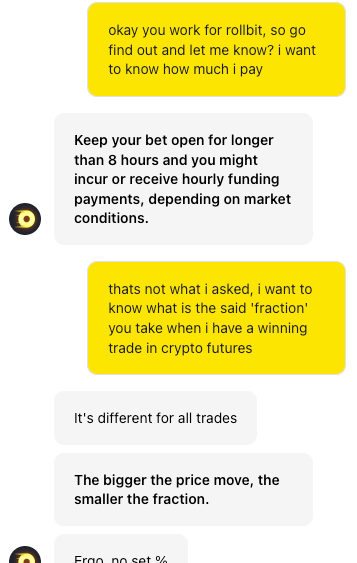

An example of this recently emerged when users complained about a ‘hidden fee’ that Rollbit was charging on leveraged trading positions. Rollbit countered that the existence of such fees was clearly stated, and indeed their website notes that fees will be charged on profitable leverage trades.

However, it is also evident that the precise formula for calculating such fees is not readily accessible to the public - as evidenced by the fact that even Rollbit’s own customer support staff were unable to source this information.

We have also heard anecdotal evidence of individuals having their accounts frozen after large wins, typically under the pretence of territorial restrictions or insufficient KYC. Again, Rollbit may be well within its rights to make such suspensions according to its own platform T&Cs. However, the point remains that there exists no effective regulator with whom to appeal should Rollbit (or any other operator) refuse to pay out your winnings.

These problems are only magnified for the smaller platforms, which invariably fail to even provide their users with basic details regarding their underlying legal entity (perhaps they are registered in the Metaverse?)

Whilst devout decentralisation maxis bolk at the mere mention of regulation in crypto, there is a clear case for such oversight in the realm of gambling, particularly considering that the line between casino and trading platform is becoming increasingly blurred.

No Dice?

Yet in spite of hidden fees, suspicious account freezes and dubious regulatory standing, you may be surprised to learn that we still consider casino tokens such as RLB to be potentially attractive prospects.

For example, whilst we do not have visibility over Rollbit’s books, we can roughly estimate their profitability based on their claim that 20% of casino profits go to the lottery pool. If that claim holds true (which is, of course, a big ‘if’), that means Rollbit turned over at least $50 million in profit from its casino operations alone in 2022.

In our view, Rollbit’s user base and likely revenue streams more than justify its current market value, particularly in the world of crypto where being profitable is generally an alien concept. When the deflationary supply of RLB is also taken into account, it is easy to see why so many traders are forming a bullish long-term view of the token in spite of its regulatory concerns.

In terms of clones and competitors, there is certainly room for multiple players to co-exist in a market of this size. However, when evaluating these tokens you should keep in mind that the core value proposition for any casino is an active user base, and this is something you cannot simply fork.

In any case, one thing is certain. Crypto casinos may be a bet on the house but - in the absence of any meaningful regulation - there is always a chance that your house might only be made of cards.

Ribbit Recap

Before we finish up for this edition, let’s briefly update you on several of the topics that we covered in previous Ribbits.

US regulators continue to turn the screw on Binance, as further mints of the Binance USD (BUSD) stablecoin were effectively banned in a move from the New York State Department against Paxos, the US entity tasked with the issuance of the token. Both Binance and Paxos appear to have accepted the ruling, meaning that the market cap of the stablecoin will only decrease from here on out. Fortunately, there is no need to panic if you are a BUSD holder, as redemptions remain possible for the foreseeable future. However, the flight from BUSD has already begun and - as is the case when dealing with anything centralised - we would advise being proactive.

Meanwhile, in the Cantoverse, both the CANTO token price and the broader ecosystem are undergoing periods of consolidation after a parabolic run-up. This is in keeping with our previous predictions and the recovery (or lack thereof) from the Canto community will be telling.

Finally, thank you again to everyone for reading and supporting the Substack, particularly those who have supported us via paid subscriptions - it’s greatly appreciated. To those who asked about supporting us in crypto, our address for donations is ranacapital.eth.

great as always, would love to hear more about Real-World-Asset revolution in DeFi.